Even with sophisticated data and consumer profiling, success relies on the basics — that is, the right time, right place, right message directed at the right audience. When you’re thinking about how you can best reach travelers and potential travelers as they move across their digital journey, these four considerations are the key to success.

Sounds simple enough? Yes and no. Without a carefully planned strategy, you’re at risk of being overshadowed by competing destinations.

We all know that the travel journey doesn’t begin at an airport or in a car; it begins with search and discovery as travelers dream, plan, and decide on a destination. That’s why you need to be well positioned on the screen in the palm of their hand.

And because Advance Travel and Tourism has worked with travel organizations as a trusted partner for years, we can help you find the smoothest path to tourism marketing success by interpreting and using our own customer intent data.

How’s Business?

As Hilton stated in their latest Trends Report, 2023 was the year “…travelers filled airports, packed stadiums, reinvigorated restaurants and energized hotel lobbies.” Deep into the recovery, destinations throughout the Southeast saw record visitor numbers.

According to Statista, 2024 revenue from travel and tourism is projected to generate $198.7 billion in the United States alone. The report goes on to say that “travel and tourism is one of the biggest sectors in terms of global economic impact,” led by leisure travel at roughly 65 percent in the US. Moreover, “domestic leisure travelers have historically accounted for the majority of travel spending.”

Experts say the outlook is sunny for 2024. This will be the year that the industry transitions from recovery mode catch-up to true growth, reports Skift Research. The US Travel Association says that normal growth of about 2% will continue for domestic leisure travel, while business travel and international inbound tourism recover and grow, albeit more slowly, into 2025. Global tourism is expected to reach record highs, above pre-pandemic levels in some places, according to the UN World Tourism Organization.

Most travel industry leaders agree that we’re poised at the precipice of deep changes as rapid technological innovation meets global and economic forces.

Faced with the enormity of shifts at this critical moment, it’s important to pause, assess, and reflect on current industry insights and trends. The findings that follow are the result of an exclusive survey of tourism professionals focused on how they’re preparing to deal with the challenges ahead.

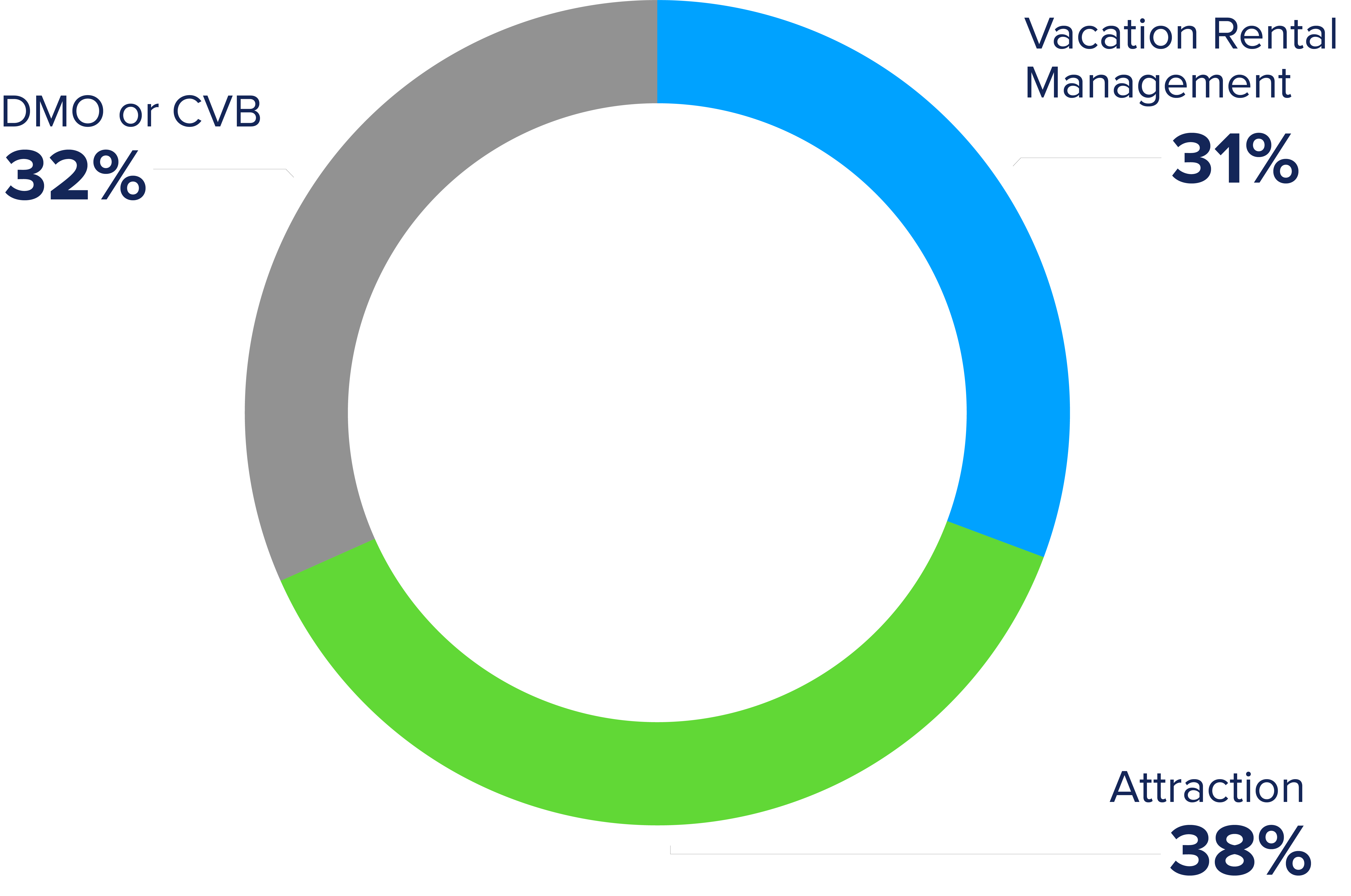

Who Are the Survey Respondents?

In late 2023, Advance Travel & Tourism analyzed more than 450 survey responses from travel industry professionals involved in destination marketing and management organizations (DMOs), attractions and lodging establishments. The objective was to uncover how travel & tourism marketers plan and strategize for their destination.

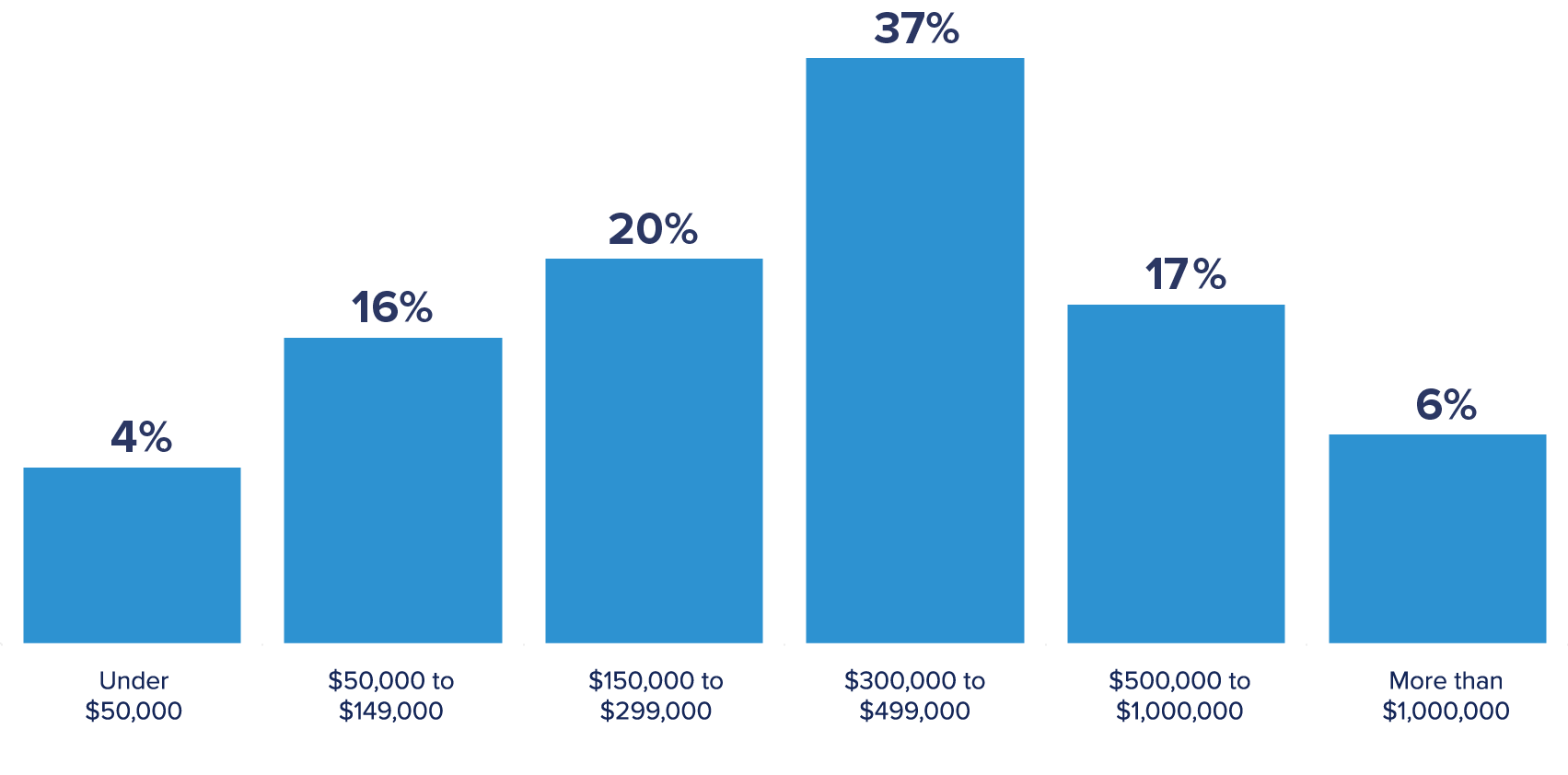

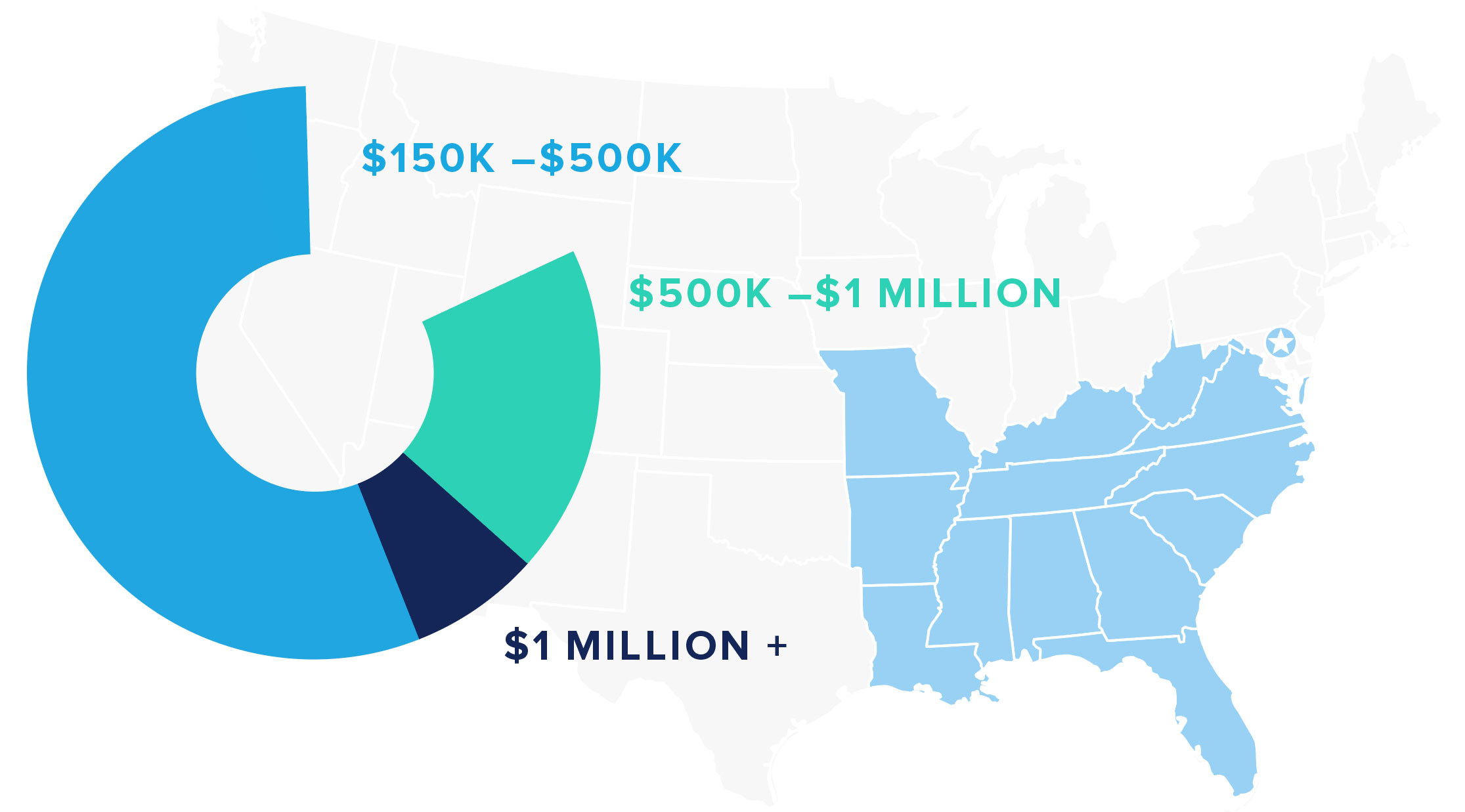

Survey respondents represent organizations of all sizes. More than 50 percent have an annual marketing spend of between $150K and $500K. Another 17 percent are spending from $500K to $1 million and seven percent spend above the $1 million mark. Survey respondents came from Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee, Virginia, and West Virginia, plus the District of Columbia.

Let’s take a closer look at the survey responses from these industry pros and what this tells us about the state of travel and tourism marketing in 2024.

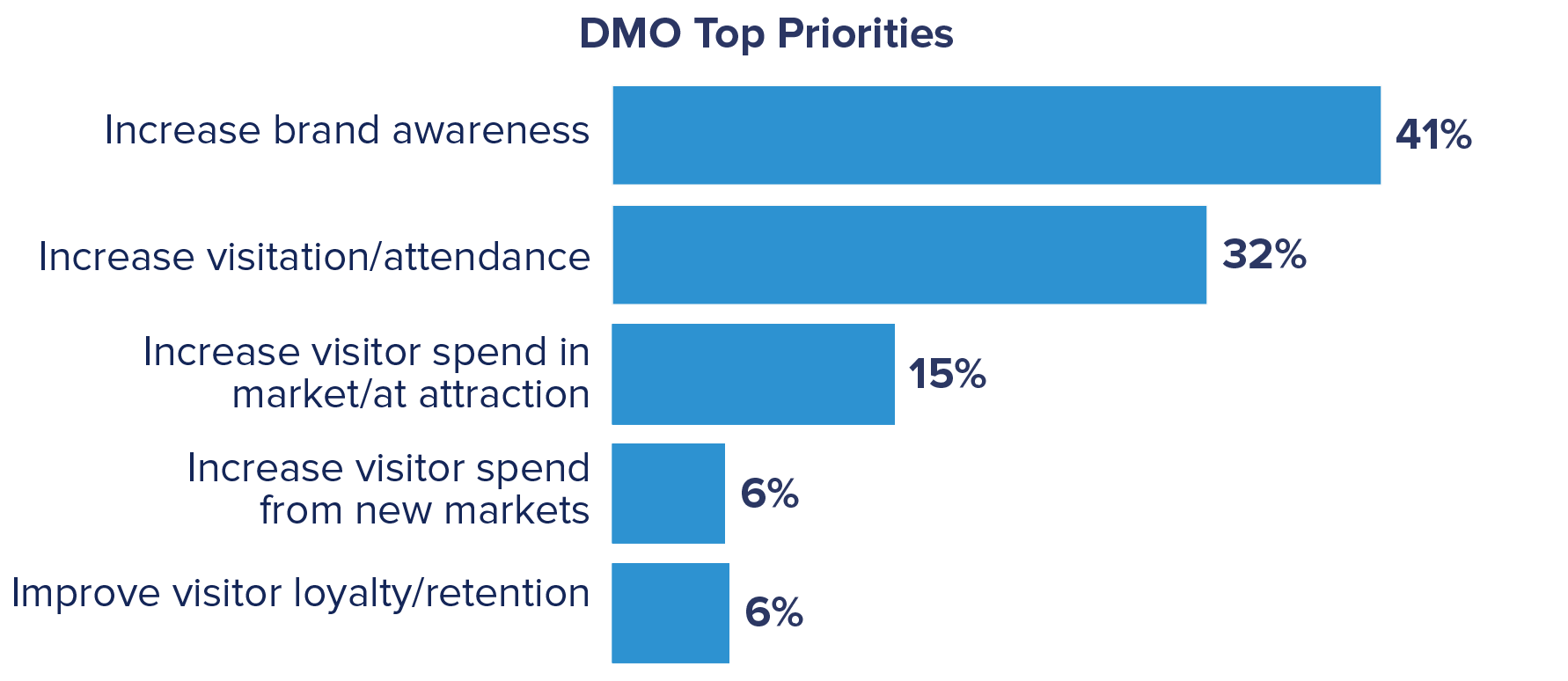

What Are DMO’s Marketing Priorities?

Interestingly, professionals from destination marketing organizations (DMOs) mention brand awareness as their number one goal for 2024, even outranking the need to increase visitor numbers.

1. BRAND AWARENESS (40%)

For destinations, increasing awareness and generating demand is paramount. Emerging from the recent pandemic years, DMOs are keenly aware that brand awareness is foundational to achieving other goals.

As with any brand, the payoff can be huge when customers feel an emotional connection. For destination marketers, the opportunities to build these connections are unlimited: visiting friends and relatives, family vacations, adventure travel, youth sports, college reunions, destination weddings, even corporate events, to name a few.

Savvy destination organizations, as well as their partners and stakeholders, will appreciate the fact that that building and maintaining positive sentiment from both residents and travelers is more significant than counting “heads in beds.”

2. INCREASE VISITATION (32%)

Destinations have moved on from using volume as a single metric. They know that an overall increase in visitation may come as a result of several additional factors such as length of stay, purpose of trip, demographics.

The pandemic taught tourism marketers lessons, too. Watching the pendulum swing from crowded to empty puts a focus on the need to manage overtourism and ensure best practice for community interests. Increasing overall visitation while also providing a positive experience involves the management of peak and valley demand across weekly, monthly, and seasonal periods.

Road trips are significant throughout the region. These 13 states and the District of Columbia are geographically within reach of an exceptionally large drive market. Kentucky, for example, is within a day’s drive for two-thirds of the nation’s population. Tennessee has the same benefit for more than half of the nation’s population and for Virginia, it’s nearly half.

3. INCREASE VISITOR SPEND (16%)

Because ‘more’ doesn’t necessarily mean ‘better,’ destinations realize that visitor spending is an important metric to track and grow in ways other than headcount. By studying situations in US and global destinations that have tackled issues around too many visitors spending too little money, we’ve gathered intelligence on possible solutions.

Questions such as: What is the origin market, what is the percentage of overnight stays, what is the average length of stay, what activities are visitors engaged in, and what is the seasonality of each key demographic? By developing strategy around the answers to these questions, visitor spending can be boosted.

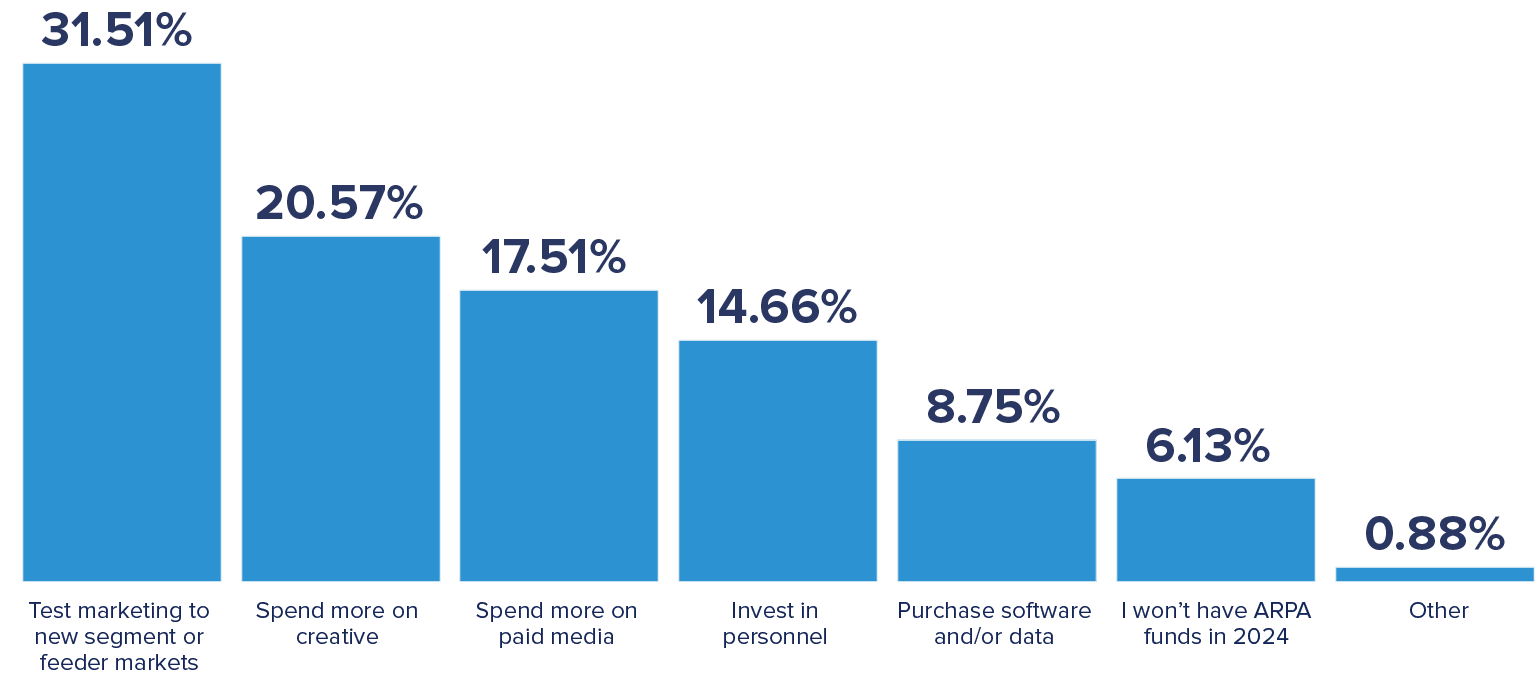

When asked about directing American Rescue Plan Act (ARPA) funds toward marketing efforts, a significant number (17.6%) indicated they would be spending more on paid media in 2024.

4. VISITATION FROM NEW MARKETS (6%)

Studies suggest that acquiring a new customer can cost five to seven times more than retaining an old one. It’s interesting to note that expanding to new markets is tied with visitor retention on the priority list.

As the traditional childrens’ scout song goes, “Make new friends, but keep the old. One is silver and the other’s gold.” Clearly, Southeast DMOs agree.

When asked about directing American Rescue Plan Act (ARPA) funds toward marketing efforts, the top answer (31.5%) from respondents is that they plan to invest in test marketing to new segments and/or feeder markets.

5. VISITOR RETENTION (6%)

Repeat visitors are the icing on the cake, but never to be taken for granted. Turning one’s attention to retaining visitors and excellent customer satisfaction represents baked-in goodness for a destination.

As returning visitors share their experiences and positive word-of-mouth spreads, the cycle is complete, coming right back to reinforce brand awareness.

Slicing Up the Paid Media Pie

Reaching repeat visitors and driving the right prospects requires having multiple paths from engagement to conversion. Based on our recent findings and given all the options at their disposal — both digital and traditional — how are DMO marketers planning to allocate paid media resources in 2024?

When asked about directing American Rescue Plan Act (ARPA) funds toward marketing efforts, a significant number (18%) indicated they would be spending more on paid media in 2024. To support these campaigns, a good number of DMOs (21%) said they planned to invest more money in creative.

Survey respondents indicate that social media (heavily favoring Meta brands Facebook and Instagram) gets the biggest share of the budget’s pie. Generous portions of the pie are shared by six additional strategies in different combinations, including video, SEM, broadcast, OOH, email, and print collateral.

SOCIAL MEDIA

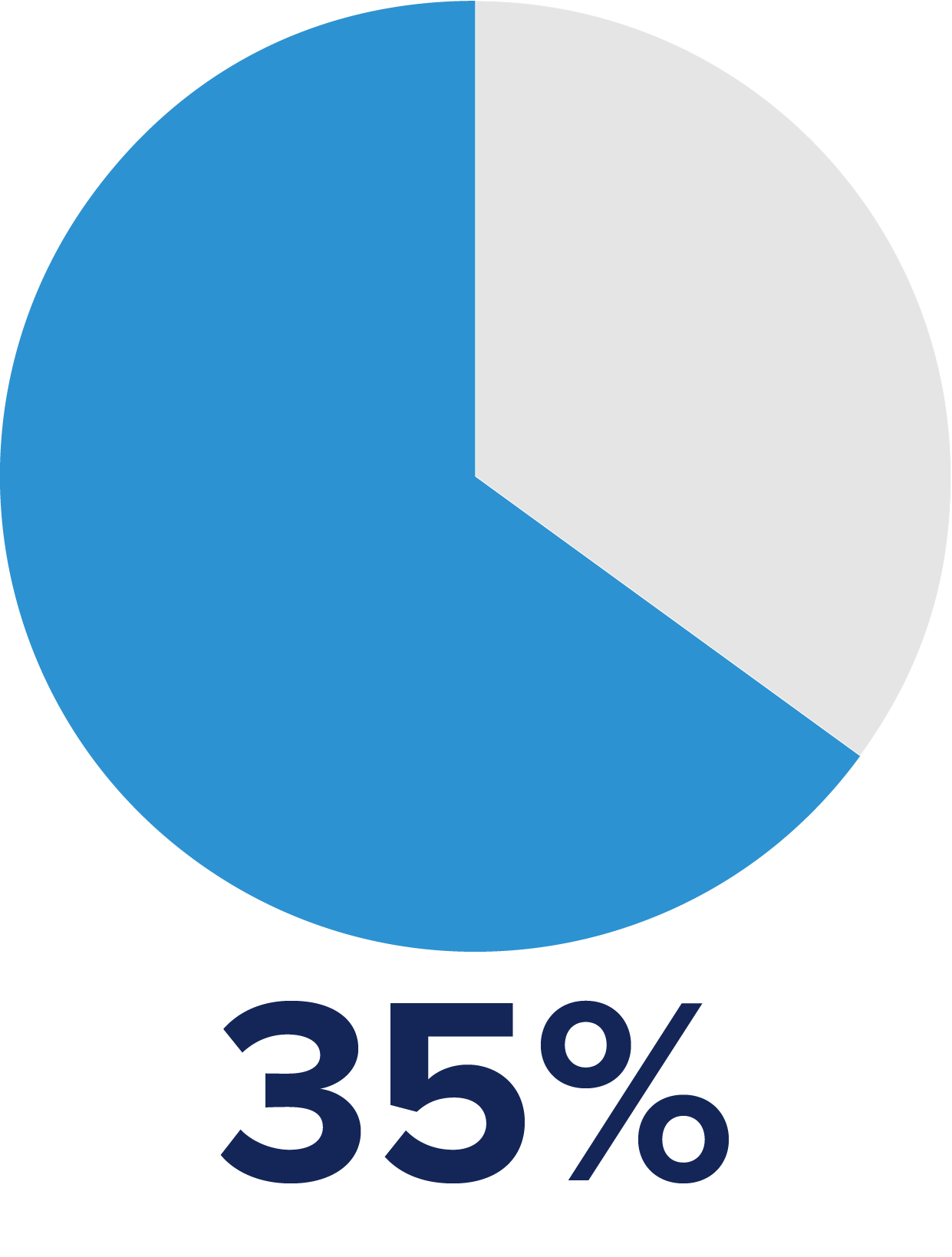

Year after year, DMOs are allocating a larger slice of the paid media pie (35.0%) to social channels. Because younger travelers are using social media at every stage of the sales funnel — including before, during, and after a trip — it’s a meaningful two-way street for communicating and engaging all year round.

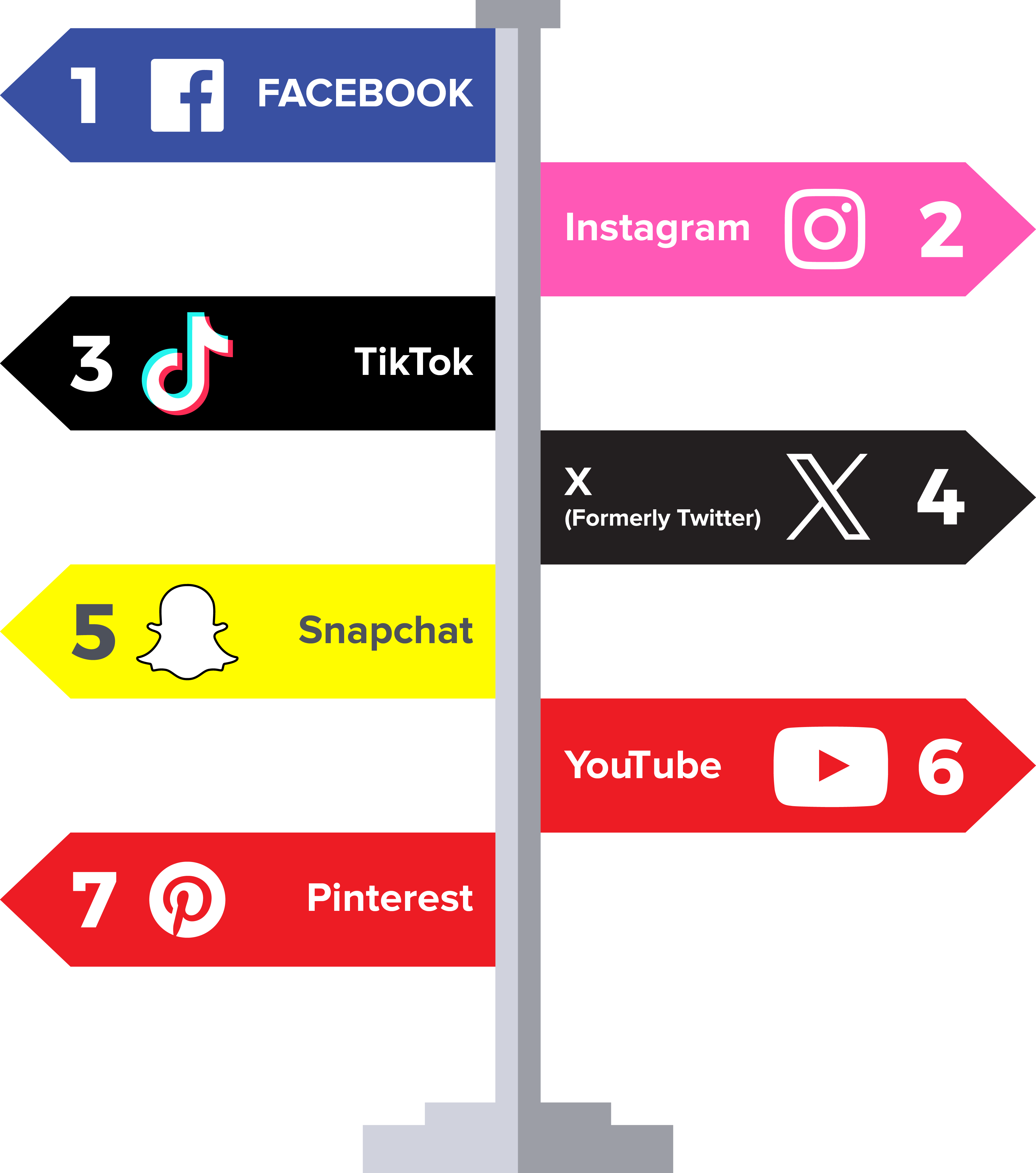

Of the social media platforms DMOs find to be the most effective at promoting travel and tourism, Facebook/Meta is the clear front runner, ranked #1 by nearly half (47.2%) of the survey respondents. Instagram is rated as the most effective channel by less than one quarter (22.2%), followed by TikTok (14.4%). Other social media platforms that rank low as being most effective for DMOs include Twitter/X, Snap, YouTube, and Pinterest. The least effective platform for DMOs is Pinterest, according to a significant number (71.3%) of respondents.

Among the metrics for measuring success, social media engagement and followers is mentioned by 58 percent of the survey respondents, making it the top answer.

Year after year, DMOs are allocating a larger slice of the paid media pie (35.0%) to social channels. Because younger travelers are using social media at every stage of the sales funnel — including before, during, and after a trip — it’s a meaningful two-way street for communicating and engaging all year round.

Of the social media platforms DMOs find to be the most effective at promoting travel and tourism, Facebook/Meta is the clear front runner, ranked #1 by nearly half (47.2%) of the survey respondents. Instagram is rated as the most effective channel by less than one quarter (22.2%), followed by TikTok (14.4%). Other social media platforms that rank low as being most effective for DMOs include Twitter/X, Snap, YouTube, and Pinterest. The least effective platform for DMOs is Pinterest, according to a significant number (71.3%) of respondents.

Among the metrics for measuring success, social media engagement and followers is mentioned by 58 percent of the survey respondents, making it the top answer.

Of the social media platforms DMOs find to be the most effective at promoting travel and tourism, Facebook/Meta is the clear front runner, ranked #1 by nearly half (47.2%) of the survey respondents. Instagram is rated as the most effective channel by less than one quarter (22.2%), followed by TikTok (14.4%). Other social media platforms that rank low as being most effective for DMOs include Twitter/X, Snap, YouTube, and Pinterest. The least effective platform for DMOs is Pinterest, according to a significant number (71.3%) of respondents.

Among the metrics for measuring success, social media engagement and followers is mentioned by 58 percent of the survey respondents, making it the top answer.

VIDEO

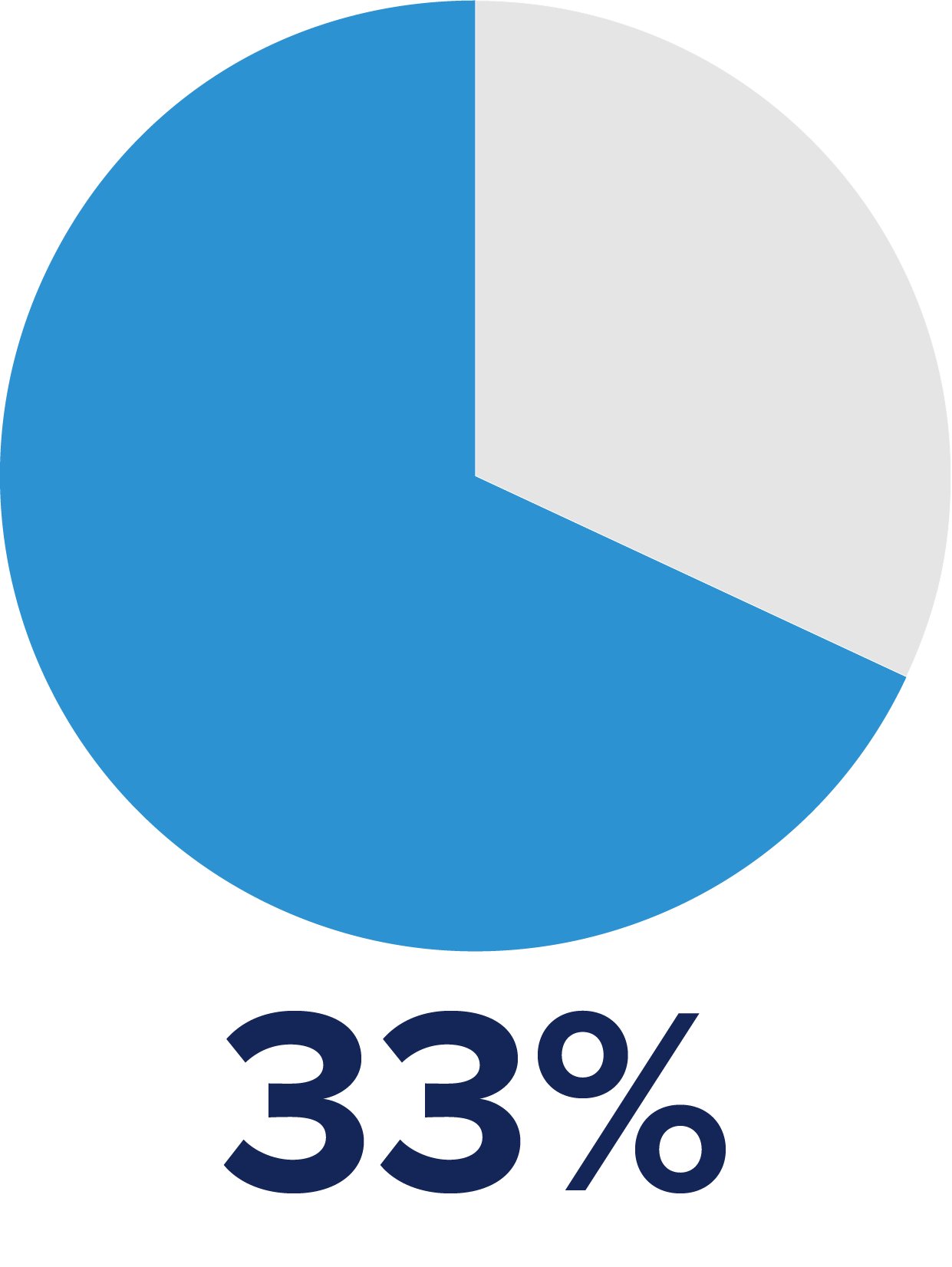

Nearly one-third (32.6%) of the DMO’s online presence is dedicated to short- and long-form video distribution, including streaming and OTT. This falls in line with a large body of industry research pointing to the steadily increasing popularity of video format.

PAID SEARCH

Another significant chunk of the annual budget (32.4%) goes to search engine marketing (SEM), a markedly changing space for organizations.

OUTDOOR ADVERTISING

In a region where road trips are popular, it’s clear why out-of-home advertising gets another hefty slice of the pie. On average, nearly one-third (32.2%) of the DMO marketing budget goes into out-of-home campaigns.

BROADCAST MEDIA

The average allocation for broadcast media (32.4%) indicates the relevance of this paid option for destination marketers. Straddling the line between audio broadcast and digital, podcasts have gained in popularity with destinations putting out low cost, niche content. Some DMOs have experimented with creative use of broadcast media including interactive video games, documentaries, and original scripted film storytelling that’s created as a series for digital streaming.

EMAIL MARKETING

Not to be overshadowed by newer forms of digital advertising, traditional email marketing holds steady. This communication option continues to carve out considerable (31.5%) resources from paid media budgets.

DMOs and their audiences have not fallen out of love with print collateral, which continues to attract a respectable (31.6%) of budgetary allocations. Many destinations operate visitor center networks located in urban centers and along state highways where travelers stop for information and takeaway brochures.

How Do You Measure Success?

While travel marketers may differ on which media channel is best, everyone looks for a return on investment. A multi-channel media strategy requires comprehensive analytics from multiple sources.

To maximize ROI, marketing success at every stage of the conversion funnel should be understood. If one part of the strategy breaks down, it causes downstream effects to be masked. Therefore, if you aren’t paying attention to all your analytics — or using the wrong ones — you can’t diagnose problems or pivot to optimize results quickly. DMOs keep a sharp eye on social media engagement (57%), website traffic (44%), sales conversion (34%) and customer satisfaction surveys shared by attractions and lodging partners.

Destinations responding to the 2024 Travel Marketing Survey shared information on the vendors they partner with to produce essential data intelligence. These vendors can report and interpret key performance indicators including hotel occupancy, short-term vacation rentals, road trips of 50 miles-plus, geolocation, retail foot traffic, travel intent, and more. It is common for destination marketers to use more than one visitation platform simultaneously to support their strategy and objectives.

Among the most widely used are: Tourism Economics Symphony (45%); Key Data (42%); AirDNA (38%); Zartico (36%); Placer AI (31%); and Buxton (22%).

Market Watch: Travel and Tourism Trends

“Local gastronomy, nature, wellness and rural tourism experiences will take centre stage in travel in 2024.”

SANDRA CARVAO

Chief of Market Intelligence & Competitiveness, World Tourism Organization (UNWTO)

“Jack be nimble, Jack be quick…” Since 2020, destination marketers have had plenty of practice with skills like pivoting and flexibility. Watching consumer travel trends to stay ahead of the curve is essential for a nimble organization.

Smart digital marketers are keeping an eye on the following trends, adapting content, product, and messaging accordingly:

WELLNESS

Rest, relax, retreat, unplug, and detox. It’s more than just the lure of a spa treatment, yoga mat, or a mud bath. As global strife and politics loom large, travelers are taking trips to get away, recharge their batteries, and spend quality time with loved ones. The Global Wellness Institute predicts wellness tourism will grow 21% by 2025, becoming the leading growth sector within the wellness category.

ADVENTURE

Mother Nature for the win. Finding ways to stay active and safe during the pandemic prompted a newfound interest in getting out into the fresh air. The trend continues to appeal to travelers that embrace hiking, biking, skiing, surfing, boating and any number of outdoor adventures in national, state, and regional parks. Astrotourism gets a boost this year when the path of the solar eclipse on April 8, 2024 makes a swathe across North America.

CULINARY

A desire to broaden authentic in-destination experiences is driving an increase in culinary-related travel. Hyper-local, slow travel, and personalization are three adjoining trends that fit hand-in-glove with tailor-made, customized foodie tours. After all, everybody likes to eat. And if you are what you eat, gastronomy tourism is a brilliant way to experience local culture and custom.

SUSTAINABILITY

Shifting consumer priorities have put a spotlight on ecotourism that’s here to stay. From carbon offsetting to wildlife conservation, and from green transportation to community-based voluntourism initiatives, it’s personally compelling for travelers to look after the local environment in the places they go.

ACCESSIBILITY

Tourism destinations, products, and services that can be enjoyed by all is a social responsibility that’s gaining more attention every day. Currently estimated to be one in four Americans (27%) having some kind of a disability, the percentage of people potentially traveling with a special need increases as the population ages.

SEASONALITY

Shoulder season and off-season gain new appeal as antidotes to overtourism, and it’s all good. Nobody ever liked standing in line, right? Crowds ease up, fares and rates drop, temperature extremes level off. Perhaps as a benefit from the increase in remote workers, there’s now greater choice about when to travel.

We Reach Travelers and Bring Them to You

Advance Travel and Tourism can help you reach the right travelers at the right time and place with your destination’s unique story. Follow us on LinkedIn and contact us today to learn more about how data-driven insights support an audience engagement strategy that will achieve exceptional delivery and results.

Contact us today to discuss your tourism marketing strategy.

Ad Choices

Ad Choices